Front-Running Bots in Crypto: Understanding, Risks, and Prevention

페이지 정보

본문

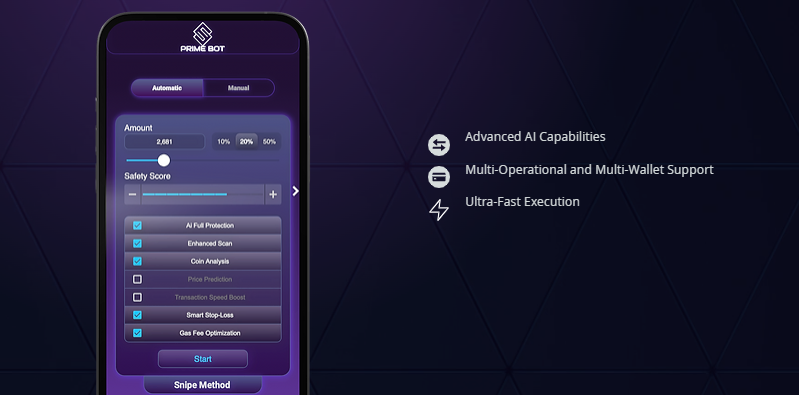

A Telegram snipe bot is an automated tool designed to help traders execute trades with precision and speed, often during critical moments such as token launches or sniper bot crypto bot solana significant market events. As the cryptocurrency market grows increasingly competitive and fast-paced, traders are constantly seeking tools to gain an edge in executing timely and profitable trades. One such tool that has gained popularity is the snipe bot, particularly in Telegram, a platform known for its use by crypto communities.

As the crypto market evolves, regulatory bodies may introduce rules to address these practices, especially as decentralized finance becomes more prominent. Front-running bots exploit weaknesses in blockchain systems and harm regular traders by driving up prices or manipulating transactions. However, just because front-running isn’t explicitly illegal in many jurisdictions doesn’t mean it’s ethical.

As the crypto market evolves, regulatory bodies may introduce rules to address these practices, especially as decentralized finance becomes more prominent. Front-running bots exploit weaknesses in blockchain systems and harm regular traders by driving up prices or manipulating transactions. However, just because front-running isn’t explicitly illegal in many jurisdictions doesn’t mean it’s ethical.

A DeFi sniper bot is an automated tool designed to execute trades at precise moments, often during the launch of a new token or during critical market shifts. In this article, we’ll explore what DeFi sniper bot crypto bots are, how they work, and the risks and benefits they present for traders in the rapidly evolving DeFi ecosystem. These bots can outperform human traders by milliseconds, capitalizing on opportunities faster than manual transactions.

Due to the nature of these events, token prices can fluctuate significantly in seconds, making sniper bot crypto bots highly valuable for those looking to buy in at the lowest possible price or capture short-term price movements. This automated trading tool is especially useful during Initial DEX Offerings (IDOs) or token listings, where tokens are launched on decentralized platforms like Uniswap, PancakeSwap, or SushiSwap.

These bots are programmed to execute trades the moment a token is listed on decentralized exchanges (DEXs) such as Uniswap or PancakeSwap, allowing traders to get in on the action faster than they could manually. What is a Telegram Snipe Bot?

A Telegram snipe bot is an automated trading bot that operates through the Telegram platform, typically through specific bot commands or integrations with Telegram groups dedicated to cryptocurrency trading.

What is MEV?

Miner Extractable Value (MEV) is the value that can be captured by miners or validators by influencing the order in which transactions are processed in a block. This may include strategies like front-running, back-running, or sandwich attacks. Since miners control which transactions are included in a block and in what order, they have the power to optimize the transaction sequence to their benefit.

Speed: Sniping bots can execute trades at speeds that are simply unattainable for liquidity bot solana human traders. This gives them a significant advantage in highly competitive markets.

Accuracy: Bots can be programmed to follow precise trading strategies, binance sniper bot reducing the risk of human error.

In the fast-paced world of cryptocurrency, trading bots have become indispensable tools for both casual traders and institutional investors alike. A newer addition to this family of bots is the BSC Sniping Bot, which operates on the Binance Smart Chain (BSC), an increasingly popular blockchain for trading. These bots are specifically designed to react quicker than human traders, executing trades based on preset strategies. Among the most popular trading bots are sniper bot crypto Bots, Front-Run Bots, and Sandwich Bots—each offering distinct advantages in decentralized finance (DeFi).

Traders use these bots to "liquidity snipe bot" tokens—purchasing them immediately after they become available to capture gains before prices rise due to high demand. Given the highly volatile nature of the cryptocurrency market, particularly with newly listed tokens, the ability to buy tokens within seconds of their launch can make a significant difference in profitability.

While these bots can profit from the transparency of blockchain transactions, they also create unfair advantages and can harm regular users by increasing costs and crypto sniper bot manipulating markets. Front-running bots in crypto are a growing concern for traders on decentralized exchanges. By understanding how front-running bots operate and adopting strategies like using limit orders, increasing transaction privacy, and exploring Layer 2 solutions, traders can protect themselves and improve their chances of successful trading.

For example, if it detects a large buy order that is likely to drive up a token's price, it might place its own buy order ahead of the original transaction (front-running) and then sell the tokens for a quick profit. Analyzing Profitable Opportunities: The bot uses algorithms to determine which transactions can be exploited for MEV.

In the world of decentralized finance (DeFi), where speed, automation, and transparency define the trading landscape, the concept of Miner Extractable Value (MEV) has become a hot topic. This phenomenon has given rise to MEV bots, which are sophisticated tools used to exploit these opportunities and generate significant profits. MEV refers to the additional profits that miners (or validators in proof-of-stake systems) can extract from blockchain transactions by prioritizing, reordering, automated trading bot or censoring transactions within a block.

A DeFi sniper bot is an automated tool designed to execute trades at precise moments, often during the launch of a new token or during critical market shifts. In this article, we’ll explore what DeFi sniper bot crypto bots are, how they work, and the risks and benefits they present for traders in the rapidly evolving DeFi ecosystem. These bots can outperform human traders by milliseconds, capitalizing on opportunities faster than manual transactions.

Due to the nature of these events, token prices can fluctuate significantly in seconds, making sniper bot crypto bots highly valuable for those looking to buy in at the lowest possible price or capture short-term price movements. This automated trading tool is especially useful during Initial DEX Offerings (IDOs) or token listings, where tokens are launched on decentralized platforms like Uniswap, PancakeSwap, or SushiSwap.

These bots are programmed to execute trades the moment a token is listed on decentralized exchanges (DEXs) such as Uniswap or PancakeSwap, allowing traders to get in on the action faster than they could manually. What is a Telegram Snipe Bot?

A Telegram snipe bot is an automated trading bot that operates through the Telegram platform, typically through specific bot commands or integrations with Telegram groups dedicated to cryptocurrency trading.

What is MEV?

Miner Extractable Value (MEV) is the value that can be captured by miners or validators by influencing the order in which transactions are processed in a block. This may include strategies like front-running, back-running, or sandwich attacks. Since miners control which transactions are included in a block and in what order, they have the power to optimize the transaction sequence to their benefit.

Speed: Sniping bots can execute trades at speeds that are simply unattainable for liquidity bot solana human traders. This gives them a significant advantage in highly competitive markets.

Accuracy: Bots can be programmed to follow precise trading strategies, binance sniper bot reducing the risk of human error.

In the fast-paced world of cryptocurrency, trading bots have become indispensable tools for both casual traders and institutional investors alike. A newer addition to this family of bots is the BSC Sniping Bot, which operates on the Binance Smart Chain (BSC), an increasingly popular blockchain for trading. These bots are specifically designed to react quicker than human traders, executing trades based on preset strategies. Among the most popular trading bots are sniper bot crypto Bots, Front-Run Bots, and Sandwich Bots—each offering distinct advantages in decentralized finance (DeFi).

Traders use these bots to "liquidity snipe bot" tokens—purchasing them immediately after they become available to capture gains before prices rise due to high demand. Given the highly volatile nature of the cryptocurrency market, particularly with newly listed tokens, the ability to buy tokens within seconds of their launch can make a significant difference in profitability.

While these bots can profit from the transparency of blockchain transactions, they also create unfair advantages and can harm regular users by increasing costs and crypto sniper bot manipulating markets. Front-running bots in crypto are a growing concern for traders on decentralized exchanges. By understanding how front-running bots operate and adopting strategies like using limit orders, increasing transaction privacy, and exploring Layer 2 solutions, traders can protect themselves and improve their chances of successful trading.

For example, if it detects a large buy order that is likely to drive up a token's price, it might place its own buy order ahead of the original transaction (front-running) and then sell the tokens for a quick profit. Analyzing Profitable Opportunities: The bot uses algorithms to determine which transactions can be exploited for MEV.

In the world of decentralized finance (DeFi), where speed, automation, and transparency define the trading landscape, the concept of Miner Extractable Value (MEV) has become a hot topic. This phenomenon has given rise to MEV bots, which are sophisticated tools used to exploit these opportunities and generate significant profits. MEV refers to the additional profits that miners (or validators in proof-of-stake systems) can extract from blockchain transactions by prioritizing, reordering, automated trading bot or censoring transactions within a block.

- 이전글A Handbook For Key Mercedes From Beginning To End 24.10.16

- 다음글What Is The Secret Life Of Window Doctor 24.10.16

댓글목록

등록된 댓글이 없습니다.